Don’t let your travel insurance blind sided you in the moment of needs, such as COVID-19 pandemic. Always check for exclusion.

Category Archives: Insurance

Socso: INVALIDITY PENSION

Just sharing information that I found recently. Socso provide pension in cases where illness / injury not related to work.

Invalidity Pension

Source: https://www.perkeso.gov.my/en/invalidity-pension.html

Radiation Sickness – Exclusion / Limitation from Medical Insurance

Recently with some idiots stealing radioactive equipment and those who had been exposed to radiation may not be covered under their medical card.

Below are the exclusion that I found in one of my medical card contract (ALIANZ).

Continue reading

TOURIST TRAGEDY Brit holidaymaker dies of blood poisoning after not having the insurance to fly back to UK hospital

Stranded visitor Michael Doyle, 29, had six operations during his trip to Bulgaria but couldn’t raise enough money to get back to Britain

A BRITISH tourist who suffered blood poisoning while on holiday has died after not being able to raise enough money to return home to the UK.

Continue reading

What is the motor claims guide?

Motor Claims Guide is a comprehensive guide developed by the Malaysian insurance and

takaful industry containing key information regarding motor insurance/ takaful.

The Motor Claims Guide aims to help the public better understand the overall claims

settlement process by making transparent key information.

Download PDF : What is Motor Claim Guide Combine?

Source:Â http://www.bnm.gov.my/documents/Accident_Assist/

Great Eastern Life Assurance – Smart Extender Rider

How does it work?

Example

Wow! this smart extender comes with NO lifetime limit but is it suitable? Take the example above, at the end of the day you can only claim RM30K out of the RM90K total bill.

Source: GE Smart Extender

Allianz Malaysia Panel Hospital

PB HealthCare

Recently received a call from telemarketer promoting PB Health Care plan. Perhaps my mandarin is bad but the insurance product she is selling is too good to be true whereby guaranteed in no change of premium until maturity (age 70).

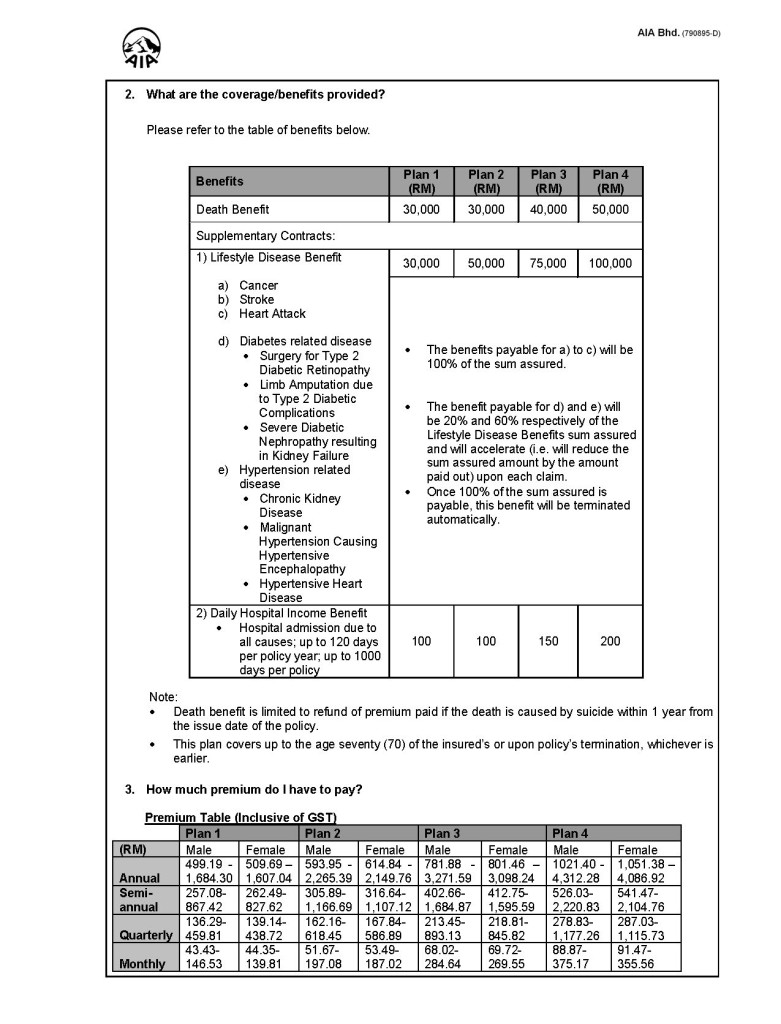

Based on my current age of 31, the telemarketer informed that my monthly premium is as follow

Plan 2 – RM81.36 monthly

Plan 4 – RM146.28 monthly

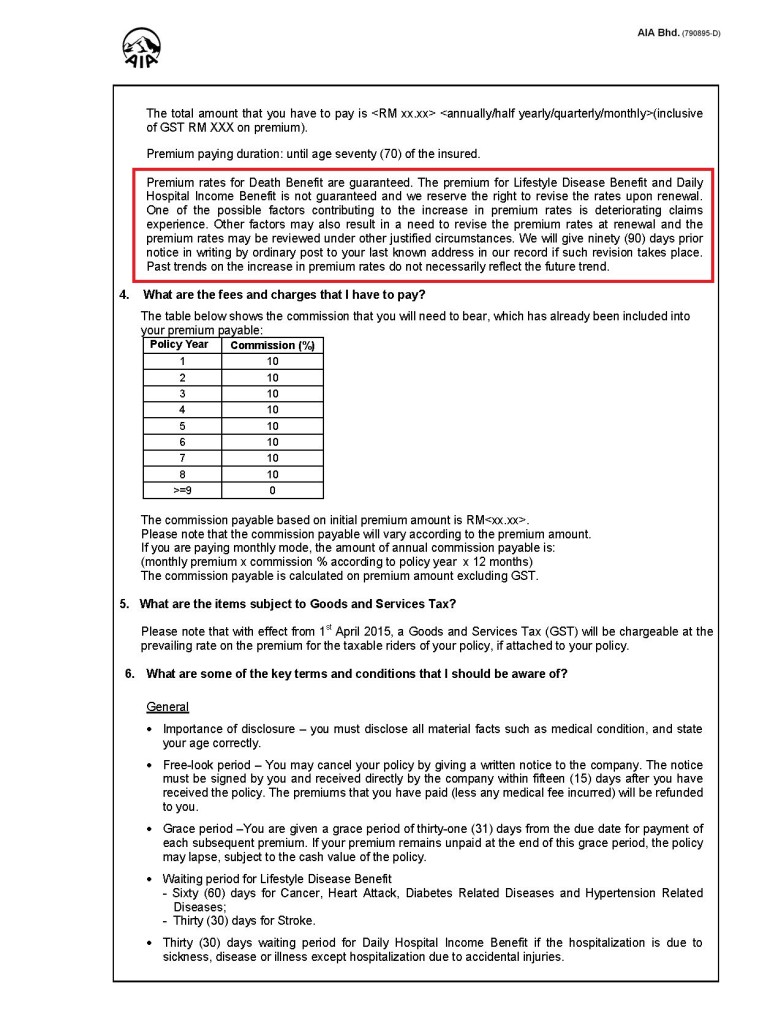

So I did a further check on their Website PB HealthCare but discovered from the PRODUCT DISCLOSURE SHEET that what the telemarketer said is misleading. According to the PDS only Premium of Death Benefits are guaranteed while premium for Lifestyle Disease Benefit and Daily Hospital Income Benefit is NOT guaranteed.

Telephone Conversation between me and telemarketer (Jump to 2.33 for telemarketer saying about guaranteed premium 这个ä¿è´¹ä¸ä¼šæ ¹æ®ä½ 的年龄在起价)

The NON Guaranteed Premium Clause

Download Product Definition Sheet here

PDS_PB-Health-Care_English

Allianz PrimeCare

I recently bought a new policy from Allianz with a monthly premium of RM115. This plan cover more than 100 critical illness and pay half the sum assured at early stage if diagnosed with critical illness (Carcinoma in situ)

My policy comes with the following:

- Life Sum Assured- RM5,000

- Cancer Recovery Benefit – RM70,000

- Diabetes Recovery Benefit – RM40,000

- Critical Illness Sum Assured – RM200,000

- Total and Permanent Disability – RM5,000

Attached is the brochure Prime_Care_Factsheet_AZ0715_23Jun15_R1

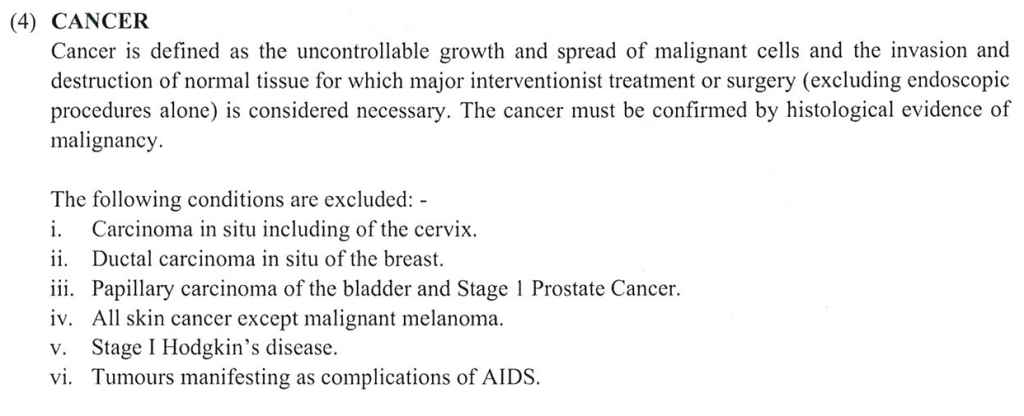

Cancer Coverage

Refer to my earlier post, most of us may not be aware that most insurance coverage do not cover early stage cancer instead most plan will only pay at end stage cancer.

Plan to upgrade my Critical Illness plan ASAP.